Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts.

Step 2: Clear expenses to the income summary account

A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period. At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance. For each temporary account there will be a closing journal entry.

- In short, we can clear all temporary accounts to retained earnings with a single closing entry.

- On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent.

- The balances from these temporary accounts have been transferred to the permanent account, retained earnings.

Trial Balance

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Retained earnings are defined as a portion of a business’s profits that isn’t paid out to shareholders but is rather reserved to meet ongoing expenses of operation. Expert advice and resources for today’s accounting professionals.

Do permanent accounts get closed?

Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period. The Income Summary account has a credit balance of $10,240 (the revenue sum). The net result of these activities is to move the net profit or net loss for the period into the retained earnings account, which appears in the stockholders’ equity section of the balance sheet.

“The books” are a business’s revenue, expense, and income summary reports. Business owners can close their books by zeroing out their income and expense accounts and then plugging net profit (or loss) into the balance sheet. All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting year.

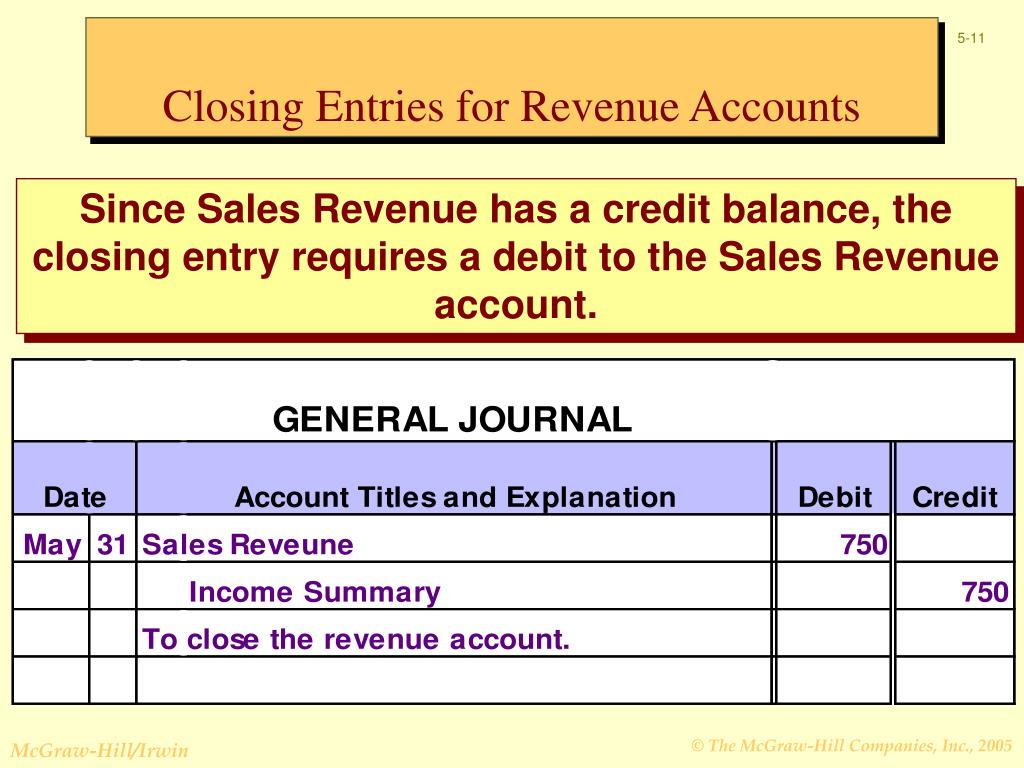

Permanent accounts, also known as real accounts, do not require closing entries. Examples are cash, accounts receivable, accounts payable, and retained earnings. These accounts carry their ending balances into the next accounting period and are not reset to zero. This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account. We see from the adjusted trial balance that our revenue account has a credit balance. To make the balance zero, debit the revenue account and credit the Income Summary account.

Whether your company uses single or double-entry accounting, you will need to ensure the proper method of opening and closing journal entries happens at the designated time. The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account. Temporary accounts are used to record accounting activity during a specific period.

In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management. Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. Notice that the balances in the expense accounts are now zero and are ready to accumulate expenses in the next period.

This ledger is used to record all transactions over the specific accounting period in question. This list of general ledger accounts 5 missteps to avoid when evaluating internal controls with their balances is known as the trial balance. If dividends were not declared, closing entries would cease at this point.

It’s not necessarily a process meant for the faint of heart because it involves identifying and moving numerous data from temporary to permanent accounts on the income statement. Remember, when using the double-entry system, you must always debit one account and credit another for the same amount. It is also important to note that the income summary account is primarily used in the manual accounting process.